“`html

Effective Ways to Take Credit Card Payments in 2025

As businesses continue to evolve in the digital age, understanding how to accept credit cards effectively is crucial for success. In 2025, with rapidly changing consumer behavior and technology, it’s essential to adapt to the latest trends and solutions. This article will explore **credit card payment processing** strategies, the best **credit card payment systems**, effective **online credit card payments**, integration techniques, and more. Read on to discover proven solutions to enhance your payment processes and ensure secure transactions.

Understanding Credit Card Payment Processing

Credit card payment processing is the underlying technology that enables businesses to accept card-based payments from customers. Whether you run a brick-and-mortar store or an e-commerce platform, knowing the best **credit card payment methods** will help streamline your operations. In essence, it encompasses methods such as traditional **credit card terminals**, **virtual terminals for payments**, and **mobile credit card payments** solutions. By mastering the nuances of these systems, businesses can improve customer experiences while managing costs associated with **credit card processing fees**.

Types of Credit Card Payment Solutions

There are a variety of **credit card payment solutions** available for businesses, each catering to specific needs. The two major types are card-present and card-not-present transactions. Card-present systems typically involve the use of **credit card terminals** where customers swipe or tap their credit cards. In contrast, **online credit card payments** are processed through payment gateways, allowing for purchases made over the internet. Furthermore, businesses must also consider **contactless credit card payments**, which have gained popularity for their speed and convenience.

Integration of Payment Gateways

Integrating a reliable payment gateway is key to a seamless online shopping experience. A **payment gateway integration** simplifies the transaction process, allowing businesses to accept payments through their websites or apps effortlessly. When choosing a gateway, ensure that it can handle various **credit card payment options** and supports features like automated **credit card chargeback management** to minimize disputes. Some popular choices include PayPal, Stripe, and Square, each offering unique functionalities to enhance transaction security.

Merchant Account Setup

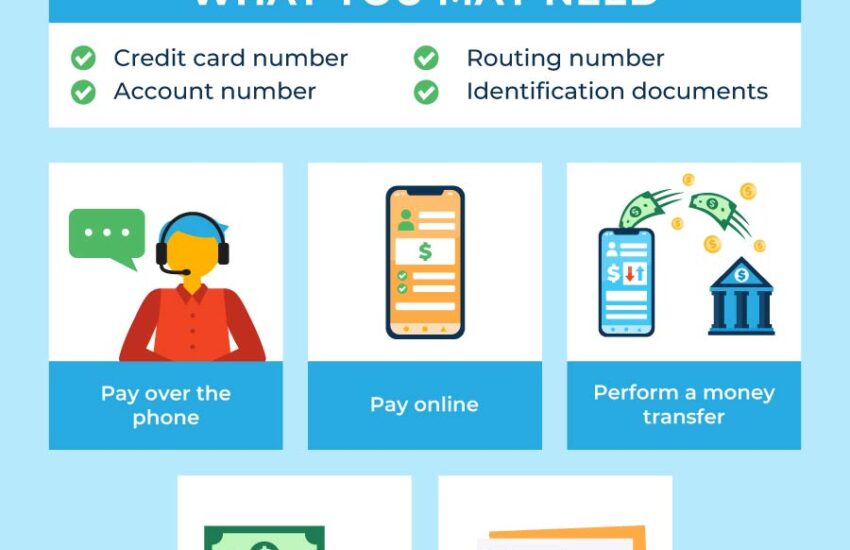

To start accepting credit card payments, setting up a **merchant account** is a critical step. This type of account allows businesses to process credit card payments securely. During the **credit card onboarding process**, you will need to provide information about your business, including legal documentation, to meet **credit card acceptance requirements**. Most merchant account providers also help businesses navigate fees associated with **credit card transaction processing**, ensuring you understand every cost involved in accepting card payments.

Security in Credit Card Transactions

Ensuring secure credit card transactions is paramount for any business. Today’s consumers are increasingly concerned about privacy and security, making **credit card payment security** a top priority. Implementing **PCI compliance for merchants** is essential to protect cardholder data during transactions. By adhering to PCI standards, businesses not only safeguard sensitive information but also build customer trust.

Fraud Prevention Measures

Adopting a proactive approach to fraud is crucial for maintaining secure transactions. Businesses should install **credit card fraud detection systems** that monitor transactions for unusual patterns and unauthorized access attempts. Training staff on recognizing fraudulent behaviors during the **customer payment experience** can also significantly reduce potential risks. Automated tools that provide real-time alerts are invaluable for early fraud detection practices.

Employee Training on Payment Security

Investing time in training for credit card processing helps ensure that your team is knowledgeable about security measures. Regular workshops can educate employees about the **credit card authorization process**, handling customer queries, and recognizing potential fraud. A well-informed team is key to **credit card chargeback management** and safeguarding your business’s reputation.

Implementing Virtual Payment Solutions

With the rise of remote transactions, adopting virtual payment solutions can elevate your business’s operations. A **virtual terminal for payments** allows you to process payments online without the need for hardware. This is particularly beneficial for businesses offering services or products over the phone or through invoicing. Notably, virtual payment systems often integrate with existing **credit card payment software**, enhancing functionality and customer experience.

Optimizing Your Card Payment Systems

To maximize efficiency, regular assessment and optimization of your **card payment systems** is important. Improving the customer experience includes ensuring quick and straightforward checkout processes, which can reduce cart abandonment rates in e-commerce transactions. Utilizing **credit card payment analytics** can provide insights into customer behaviors and preferences, enabling adjusted strategies for better user engagement.

Checkout Optimization Techniques

Optimizing your checkout process means reviewing every step a customer takes from selection to purchase. Streamlining steps can include offering guest checkout options, multiple payment methods, and minimizing required fields in forms. Utilizing tools and software that focus on improving the **customer experience with credit card payments** can enhance satisfaction and ultimately encourage repeat business.

Comparing Credit Card Payment Systems

When choosing between **credit card payment systems**, businesses should conduct thorough **credit card payment systems comparison**. Factor in monthly fees, transaction costs, available features, and customer service before making a decision. Keeping abreast of emerging trends like **recurring credit card payments** and **EMV credit card processing** can help businesses stay ahead and choose the most suitable systems for their unique needs.

Conclusion and Key Takeaways

As we approach 2025, understanding effective ways to take credit card payments will remain foundational for business success. Embracing diverse **credit card payment methods**, ensuring transaction security, optimizing payment systems, and engaging in employee education are essential elements for thriving in the marketplace. By staying informed about **credit card payment trends** and investment opportunities in technology, your business will be well-positioned to maximize revenues while ensuring customer satisfaction.

FAQ

1. How do I start accepting credit card payments for my small business?

To begin accepting credit card payments, you’ll first need to set up a **merchant account** with a payment processor. Look into various **credit card payment solutions**, including traditional terminals, **mobile credit card payments**, or online gateways, depending on your business type. Make sure to review transaction fees and **PCI compliance** requirements to ensure security.

2. What security measures should I take for credit card payments?

Security is vital for protecting customer data. Implement **credit card payment security** practices such as SSL certificates, encrypting data, and ensuring ***PCI compliance for merchants**. Additionally, consider **credit card fraud detection systems** and training employees on recognizing fraudulent activities during transactions.

3. Are there benefits to accepting contactless credit card payments?

Yes, accepting **contactless credit card payments** provides convenience and speed, enhancing the customer experience. These systems reduce wait times during transactions and can lead to increased sales due to greater customer satisfaction and quicker service delivery.

4. What are some common credit card processing fees?

Common **credit card processing fees** include transaction fees, monthly fees, chargeback fees, and equipment rental fees. It’s important to understand each fee structure when setting up your merchant account to assess the overall cost of **accepting card payments**.

5. How can I improve my customer experience during credit card transactions?

Improving customer experience can be achieved through standout **checkout optimization techniques**. Limiting form fields, ensuring multiple payment options, and providing a guest checkout can enhance user satisfaction during the payment process. Regularly use customer feedback to further tailor the payment process to meet their needs.

“`