“`html

How to Make an ACH Payment Properly in 2025: A Simple Guide to Success

The Automated Clearing House (ACH) is a vital financial network that facilitates electronic funds transfers (EFT). In 2025, understanding **how to make an ACH payment** is essential for individuals and businesses alike. Whether you need to send money to a vendor or receive direct deposits from your employer, this guide will walk you through the essential steps involved in the ACH payment process, ensuring a secure and efficient transaction.

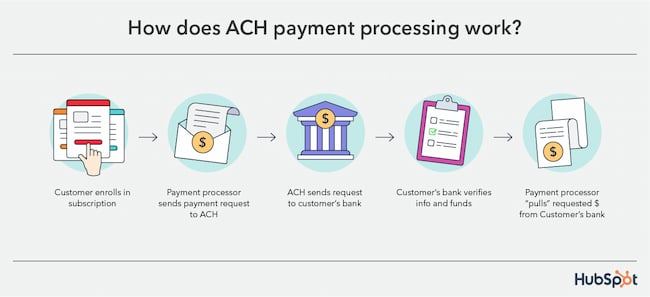

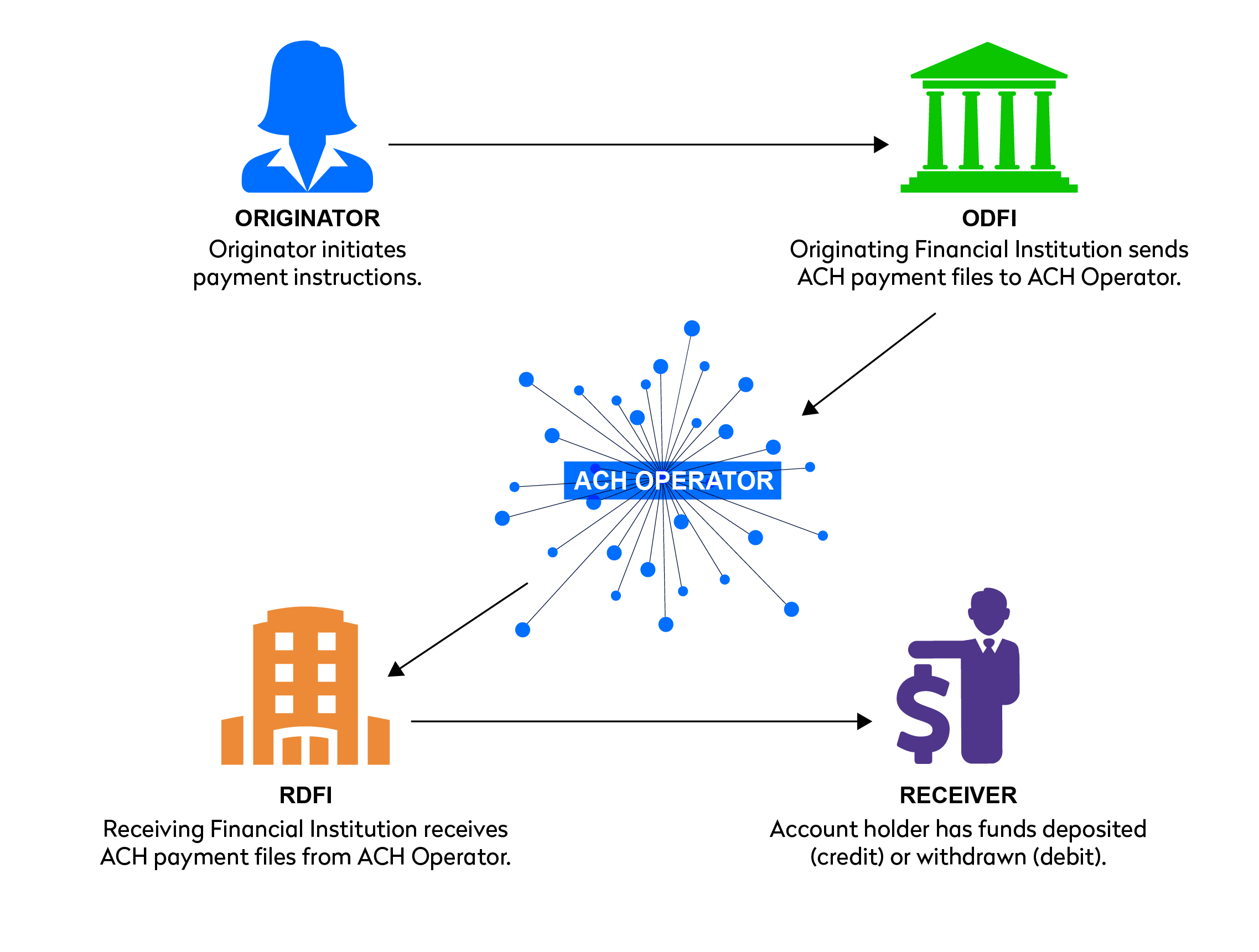

Understanding ACH Payments

The first step in mastering **ACH payments** is to have a clear understanding of what they are and how they function. **ACH payments** are electronic transactions that allow for the transfer of funds between bank accounts via the Automated Clearing House network. This method is favored for its reliability, efficiency, and lower costs compared to traditional wire transfers. When comparing **ACH payment methods**, one of the key advantages is the ease of setting up recurring payments, making it ideal for regular expenses such as utility bills and subscription services.

What is ACH Payment?

ACH payments are secure electronic transactions that can be used for various purposes, including personal use, business operations, and payroll. These transfers are initiated through the payer’s bank and sent through the ACH network to the recipient’s bank. For most users, **understanding ACH payments** begins with knowing the types involved: Consumer ACH transactions, which typically include payments made by individuals, and Commercial ACH transactions, which are used by businesses for various financial operations.

Advantages of ACH Payments

There are numerous advantages associated with using ACH payments. Primarily, they provide a streamlined **electronic funds transfer process** that reduces the time taken to clear transactions when compared to checks. Moreover, ACH payments also offer cost savings since fees are generally lower than those incurred with credit card processes or wire transfers. A noteworthy benefit of adopting ACH payment systems is the reduced need for paper checks, supporting an overall transition towards a more environmentally-friendly, digital approach to financial transactions.

Common ACH Payment Mistakes

When initiating ACH payments, users often fall prey to common pitfalls. One such mistake is entering incorrect bank account details, which can result in payment failures or misdirected transactions. Additionally, misunderstanding the approval life cycle for payments may delay transactions. Beginners should familiarize themselves with **ACH payment troubleshooting** tips to avoid these issues, ensuring a seamless payment process when using the network for sending or receiving funds.

Steps to Make an ACH Payment

Knowing the **steps to complete ACH payment** is crucial for effective financial management. Here, we’ll outline the straightforward process to follow when initiating ACH transactions seamlessly.

Initiating an ACH Payment

The process of making an ACH payment starts with gathering necessary information, which includes the recipient’s name, bank account number, and routing number. Ensure the details are correct to prevent mishaps. Once you have all the required information, you can proceed to log into your bank’s online banking or payment system, where you’ll find the option to set up an ACH transfer or payment. Following these **ACH payment instructions** will lead you through each required field on the transaction form until submission.

Setting Up ACH Payments Online

Setting up ACH payments is often as simple as filling out a form within your bank’s interface. Most banks allow for the direct authorization of payments through their online systems. Here, you’ll need to select whether you’re initiating a one-time payment or a recurring transfer. This flexibility can help both individuals and businesses manage their expenses and forecast cash flows more effectively.

Advancing Security with ACH Payments

Maintaining a **secure ACH payment setup** is paramount to protecting sensitive bank information. Be sure to follow best security practices such as using strong passwords, employing two-factor authentication when possible, and regularly monitoring account statements for discrepancies. These strategies will help reduce vulnerabilities associated with **electronic funds transfer networks** and ensure compliance with ACH standards.

Business Considerations for ACH Payments

For businesses, understanding **making business ACH payments** is essential for smooth operations. It helps in managing employee payroll, vendor payments, and maintaining cash flow efficiently. Below are several subtopics to explore this further.

Employer ACH Payment Setup

Employers looking to implement ACH payments for payroll operations should start with verifying employees’ bank account details. This information enables direct deposits, ensuring that funds reach the employees immediately after the payroll is processed. Setting up ACH contributions simplifies traditional payroll systems by reducing the need for manual checks, thereby promoting operational efficiency.

Recapping Common ACH Payment Errors

Employees and employers must be diligent in reviewing the details of ACH transactions to minimize the chances of returned or failed payments. Common errors include outdated bank details and incorrect amounts. **How to avoid ACH payment errors** requires regular audits of payment instructions and maintaining open communication with recipients to confirm details and requirements.

Benefits of ACH for Business Operations

Businesses can significantly benefit from using ACH payments through streamlined accounts payable and receivable workflows. Switching away from cash and checks to **ACH payments** can optimize cash flow, ensure timely bill payments, and support various other operational charms like membership dues and subscription services. Moreover, with the added benefit of reduced transaction costs, businesses can reinvest savings into more productive areas.

Tracking and Reconciling ACH Payments

Once you have completed an ACH transaction, the next concern should be how you track and manage these payments effectively. Proper reconciling practices will prove invaluable in the long run.

ACH Payment Tracking Tools

Utilizing **ACH payment tracking tools** can simplify the monitoring of transactions. Many financial platforms include features to track ACH payments and recognize completed or pending transactions. Such tools, along with regular bank reconciliations, help identify discrepancies and ensure that all payments are accurately recorded within the financial systems.

Managing Returned ACH Payments

Returned ACH payments can disrupt both personal and business financial processes. Common reasons for returns include insufficient funds or incorrect routing information. Having a strategy for managing these returned transactions effectively can minimize disruptions. Implementing checks before initiating payments can prevent these issues, ensuring smoother cash flow.

Understanding ACH Payment Deadlines

Timeliness is critical when dealing with ACH payments. Familiarizing yourself with **ACH payment deadlines** is essential to ensure payments arrive as expected. Most ACH transactions are processed in batches, so knowing submission times and upcoming holidays can assist users in planning their transactions better.

Key Takeaways

- **Understanding ACH payments** and how they function is crucial for effective financial management.

- Follow appropriate **steps to complete ACH payment**, ensuring all required information is correct.

- Benefits like **cost-effectiveness** and easy usable platforms make ACH ideal for individuals and businesses.

- Implement tracking and reconciliation practices to manage payments effectively.

- Security should always be a priority when setting up **ACH payments**.

FAQ

1. What is the difference between ACH and wire transfers?

ACH payments involve batch processing and typically occur within one to two business days, making them ideal for recurring transactions. Wire transfers, however, are processed in real time and often used for larger amounts, though they carry higher fees. Understanding these distinctions can guide you in choosing the best method.

2. How can I troubleshoot issues with ACH payments?

Common troubleshooting steps for ACH payments include double-checking bank account numbers, confirming routing details, and reviewing any notifications from your bank regarding transaction status. Ensuring compliance with bank regulations will also assist in preventing errors.

3. Are there fees associated with ACH payments?

While ACH payments are often more cost-effective than other payment types, fees can vary based on the bank’s policies, transaction volumes, and settlement speeds. It’s essential to clarify any potential costs when choosing your ACH provider.

4. What security measures does ACH implement?

ACH employs several robust security measures, including encryption and thorough verification processes. Maintaining secure bank account details and using reliable payment service providers are essential to protecting sensitive information.

5. Can I use ACH for international transactions?

While ACH primarily facilitates domestic transactions, there are options available for **cross-border ACH payments**. However, the process may involve additional regulations and fees. It’s critical to consult with your bank to ensure compliance.

6. How long does it take for an ACH payment to clear?

ACH payments usually clear within one to two business days, though same-day processing options are becoming increasingly available. Factors such as bank policies and transaction types can influence the timing.

“`