Effective Ways to Issue a 1099 Form in 2025: A Complete Guide to Tax Compliance

Understanding **how to issue a 1099** form is essential for both freelancers and businesses in maintaining tax compliance. As fiscal regulations evolve, especially with regards to the 1099 forms, it’s crucial to remain updated for the 2025 tax year. This comprehensive guide will detail everything about the 1099 process, including types of 1099 forms, filing deadlines, and ensures you meet IRS 1099 guidelines.

Overview of 1099 Forms

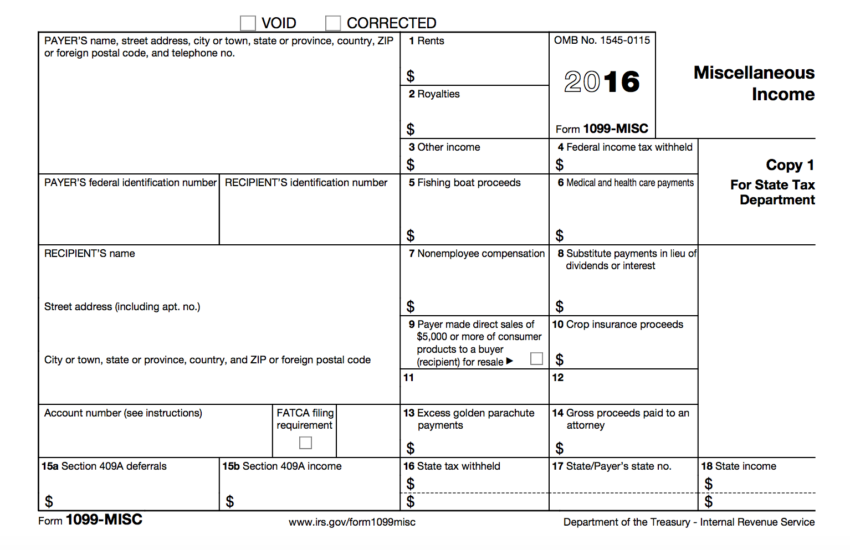

The 1099 series are important tax documents that the IRS requires for various income reporting. Unlike a W-2, which reports wages paid to employees, a **1099 form** is used to report income earned by independent contractors and freelancers. There are several types of 1099 forms such as 1099-MISC, 1099-NEC, and 1099-K, each tailored for specific reporting categories. Understanding the different **types of 1099 forms** is essential to ensure compliance with **1099 requirements for freelancers**.

What is a 1099?

A **1099** is an IRS tax form typically used to report income received that is not classified as salary or wages. This includes payments for services rendered, rental income, and miscellaneous income. For instance, if you hire freelancers for a project, you are obliged to issue a **1099 form for contractors** who are paid over $600 in a tax year. Each type of **1099 form** serves a specific purpose while providing detailed information on total earnings, required to review by the IRS against the payee’s tax obligations. Familiarizing yourself with **what needs to be reported on a 1099** will prepare you for accurate filing and taxation process.

Differences Between 1099 and W-2

While both the 1099 and W-2 forms are crucial for tax reporting, they represent different relationships between the issuer and the payee. A W-2 is issued to employees, capturing salary, withheld tax, and other employee benefits. Conversely, the **1099 tax form filing** is associated with freelancers and independent contractors, documenting various types of income received. Understanding these differences is essential for employers to meet their tax obligations accurately and helps avoid penalties for not issuing 1099 in the proper context.

Who Needs a 1099?

Generally, anyone who pays an independent contractor or freelancer $600 or more during the tax year must issue a 1099. This requirement applies to various services, including professional services such as legal advice, graphic design, and consulting. It’s critical to assess **when to issue a 1099** based on these payment thresholds and the nature of their work to avoid missing **1099 deadlines explained** by the IRS.

Filing 1099 Forms: Key Instructions

Issuing and filing a 1099 form can seem daunting, but with the right **1099 form instructions**, it can be relatively straightforward. Start by correctly gathering the necessary information from your contractors or freelancers, such as their Social Security Number or Tax Identification Number. This is typically done through a W-9 form, which contractors fill out upon commencement of their services. The collected data aids in **how to fill out a 1099** accurately, ensuring that all income is properly reported.

Common Mistakes to Avoid with 1099s

Filing a 1099 is not without its pitfalls; common mistakes include incorrect or missing taxpayer identification numbers and failing to issue a 1099 for eligible payments. Such oversights can result in penalties for the issuer, making it imperative to carefully check all entries before final submission. Implementing a **1099 reporting checklist** can effectively help mitigate these issues, ensuring timely compliance with all filing requirements.

Legal Implications of Not Issuing a 1099

Failing to issue a 1099 can lead to substantial penalties, up to $270 per form you should have issued, which stresses the importance of adherence to **1099 reporting requirements**. Businesses may also encounter additional scrutiny, which could lead not only to fines but also to audits. Keeping meticulous records of contractor payments can help prevent future discrepancies and non-compliance issues.

How to Correct a 1099 Filing Error

If an error is found on a submitted **1099 form**, how to amend it becomes an essential task. You will need to submit a corrected form alongside the original. The IRS provides specific guidelines on how to complete the **correct way to file** these corrections. Depending on the type of error, it may be as simple as filing the amended information using IRS Form 1099-X or easily revising through software solutions designed for **1099 online filing services**.

Filing Convenience: Digital Tools and Online Resources

In the modern digital age, numerous tools facilitate **electronically filing 1099 forms**. Several platforms can simplify the process, allowing business owners to issue and submit multiple 1099 forms seamlessly. Whether it is a more simplified process through accounting software or a step-by-step online guide, the goal is to reduce stress while accurately meeting IRS deadlines.

Online Filing Services: A Comprehensive Guide

Several applications exist specifically for **filing tax forms as a freelancer** and managing 1099 submissions. Utilizing these resources can save considerable time and minimize human error. Services such as eFile4Biz or Tax1099 allow users to fill out and file 1099s directly, ensuring compliance while tracking payments effectively. Familiarizing yourself with **best online tools for filing 1099** can enhance your filing experience and accuracy.

Tracking Payments for 1099 Compliance

Using technology to track payments made to contractors is essential for seamless **1099 form filing**. Implementing payment tracking software not only enhances your operational efficiency but also ensures you stay compliant with reporting. Most robust accounting software offer functionality that helps track all contractor payments automatically summaries, giving an easy overview essential for proper documentation.

How to File for 1099 Exemptions

It’s vital to note **1099 exemptions**, which could apply based on specific criteria. Certain organizations, such as non-profits or government entities, may not need to file 1099s. When in doubt, consult the IRS guidelines to verify whether the recipient qualifies for exemption and proceedings that follow to avoid unnecessary filing.

Frequently Asked Questions about 1099 Forms

1. What is the deadline for issuing a 1099 form?

The deadline for issuing a **1099 form for 2023** is typically January 31 of the following year, which means businesses should prepare to issue these forms in early 2024. If you are submitting via **1099 online filing**, the deadline may vary slightly, allowing some additional processing time. It’s important to check the IRS site for the latest updates on **1099 deadlines explained**.

2. Can I issue a 1099 form electronically?

Yes, businesses can file **electronically filing 1099 forms** through IRS-approved e-filing services. It’s a faster and more efficient way of ensuring compliance with the IRS’s requirements, allowing for easy tracking and correction if needed.

3. What information is needed to fill out a 1099?

Essential information includes the contractor’s name, address, Social Security Number (or EIN), and financial figures related to payments rendered. You may obtain this data through the contractor’s W-9 form to ensure accuracy while you complete the **how to fill out a 1099** process.

4. What are the penalties for not issuing a 1099?

If you fail to issue a 1099 when required, the IRS introduces penalties based on your business size and diligence in reporting. It’s vital to keep accurate records and comply to avoid unnecessary financial consequences, which may escalate if the IRS finds discrepancies during an audit.

5. Are there differences between variations of the 1099?

Yes, there are multiple variations of the **1099 form**, such as **1099-MISC** vs. **1099-NEC**. Each serves different purposes – while 1099-MISC was previously used for various payments including contractor payments, the IRS now specifically uses 1099-NEC for reporting non-employee compensation. Understanding the **differences between various 1099 forms** is essential for correct compliance.

For more in-depth information on implementing these strategies in practice, visit our resources at this guide and that page. Be proactive in maintaining compliance and smooth operations regarding your 1099 filing needs!