How to Effectively Add Tax to a Price

Adding tax to a price is a crucial calculation for businesses and consumers alike. Understanding **how to add tax to a price** ensures that you maintain compliance with tax regulations and accurately reflect the cost of an item. In this practical guide for 2025, we’ll explore various aspects of tax calculations, including the **price plus tax formula**, effective strategies for applying sales tax, and how local tax laws affect item pricing. Whether you are a business owner, a consumer, or a student trying to grasp this topic, our detailed guide will provide you with valuable insights.

Understanding Sales Tax

The **understanding of sales tax** is essential for anyone dealing with pricing strategies. Sales tax is a consumption tax imposed on the sale of goods and services. Factors that influence the sales tax include local regulations, state tax rates, and the category of products sold. It’s important to familiarize yourself with your area’s local tax obligations to stay compliant and effectively apply tax to prices.

Sales Tax Explained

**Sales tax explained** means clarifying how it works and affects pricing. When a product is sold, the sales tax percentage is applied to the item’s price. For example, if you have an item priced at $100 and the sales tax rate is 7%, you would multiply $100 by 0.07 to find the tax amount of $7. Therefore, the total cost with tax becomes $107. Understanding these calculations helps consumers know how much they will actually pay at checkout.

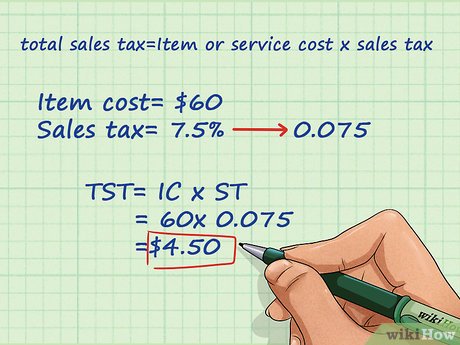

Calculating Sales Tax

To **calculate sales tax**, you can use the simple formula: Tax Amount = Item Price × Sales Tax Percentage. This method is straightforward and easily applicable to any pricing scenarios. It is critical for e-commerce businesses, where automation tools can simplify adding tax to subtotal automatically, ensuring accurate transactions for customers.

Tax on Goods vs Services

Not all products are treated the same when it comes to taxation. Understanding the **tax implications for pricing** regarding tax on goods versus services is important for compliance. Some services may be exempt from sales tax in certain jurisdictions, and other states may have different tax rules for essential goods, such as groceries or prescription medications. Recognizing these differences ensures accurate pricing and avoids potential legal issues.

Price Plus Tax Formula

The **price plus tax formula** is pivotal when determining the final sale price consumers will pay at checkout. Businesses should effectively determine this price using the tax calculation formula to ensure profitability while also meeting regulatory standards. This formula allows for clear pricing strategies that consumers can appreciate, enhancing their shopping experience.

How to Compute Tax

When you need to **compute tax**, one systematic method is to add the tax percentage to 1 before placing it against the item price. For instance, if the tax rate is 7%, you would represent this as 1.07. Therefore, for an item priced at $100, the formula would be Total Price = Item Price × (1 + Sales Tax Rate), resulting in $107. This straightforward technique is useful for quick computations and can easily be applied across various price points.

Tax Inclusive Pricing

**Tax inclusive pricing** means you present the final sale price as inclusive of the tax. This method is often beneficial in customer-facing displays where transparency is crucial. Consumers can clearly see what they will pay at checkout, alleviating confusion about hidden fees or additional taxes. For businesses, it’s important to specify whether prices displayed on the item include taxes to avoid consumer misunderstandings.

Adjusting Pricing Strategies for Changes in Tax Rates

When local or state authorities implement a **tax rate adjustment**, businesses must swiftly react to maintain profitability. It’s essential to revisit and adjust your pricing strategies promptly. Ensure that all goods and services reflect this change in their prices, maintaining accuracy in the **total cost with tax**. Regular reviews of the **sales tax percentage** and its impact on profits lead to more informed pricing decisions.

Adding Tax to Subtotal

When a customer buys multiple items, calculating the tax on a subtotal can become complex, but it’s vital for ensuring correct billing. Knowing how to effectively **add tax to subtotal** is crucial, especially in retail settings where consumers may not be fully aware of tax calculations.

Steps for Adding Tax to Subtotal

To cover how to **add tax to subtotal**, you can follow these simple steps:

- Calculate the subtotal of all items purchased.

- Identify the applicable sales tax rate.

- Use the tax calculation formula to determine the tax amount: Tax Amount = Subtotal × Sales Tax Percentage.

- Add the tax amount to the subtotal to arrive at the total cost with tax.

This process not only aids customers in understanding their total cost but also simplifies transactions for cashiers and sales personnel.

Case Study: Implementing Tax Calculations in Retail

For understanding practical application, let’s consider a retail example. A store sells three items priced at $50, $30, and $20. The subtotal is $100. If the sales tax rate is 5%, the process to add tax would be:

- Subtotal: $100

- Tax Calculation: $100 × 0.05 = $5

- Total Cost with Tax: $100 + $5 = $105

This clean process makes it easier to communicate prices and encourages sales without confusion.

Three Mistakes to Avoid When Adding Tax

While it seems straightforward, there are common mistakes businesses can make when determining tax: neglecting to adjust for specific local requirements, failing to apply the correct tax percentage, or overlooking tax exemptions for certain items. By ensuring accurate processes, retailers can avoid discrepancies that may lead to audit complications.

FAQ

1. What is the difference between sales tax and VAT?

The difference between sales tax and VAT lies in how they are implemented. Sales tax is applied only at the point of sale, while VAT is charged at every stage of production. Each approach has its own implications for pricing strategies, and it’s vital for businesses to understand these distinctions for compliance and effective pricing.

2. How do I determine the applicable sales tax rate?

To determine the applicable sales tax rate, businesses should refer to their local government websites or use tax calculation tools that reflect regional variances. Compliance with current tax laws plays a crucial role in setting accurate pricing models.

3. Are there exemptions from sales tax for certain products?

Yes, certain products may be exempt from sales tax depending on local regulations. Common categories include groceries, medical supplies, and certain services. Business owners should familiarize themselves with local tax rules to accurately manage compliance and maintain transparency with consumers.

4. How can I optimize tax calculations for my business?

Optimizing tax calculations can involve implementing digital tools or software that automatically calculate tax for online purchases. Automation minimizes errors and helps keep sales tax up to date with current laws, allowing businesses to focus on other key areas of operation.

5. What should I do if I made an error in past tax calculations?

If an error in tax calculations is discovered, it is essential to rectify it immediately. This may include issuing corrected invoices and possibly filing amended tax returns. Consulting a tax professional can also help navigate the remedy process and ensure compliance going forward.