Smart Ways to Pay Your Mortgage with a Credit Card

Understanding the Basics of Mortgage Payment with Credit Card

In recent years, an increasing number of homeowners have been exploring how to pay mortgage with credit card. This method can offer flexibility but also comes with its own set of challenges. When considering a credit card for mortgage payment, it’s important to assess your financial scenario thoroughly. Using a credit card to pay a mortgage can provide benefit options like building reward points; however, it’s essential to keep in mind potential fees associated with these transactions. A comprehensive understanding of the various mortgage credit card payment options is crucial in optimizing your financial strategy.

Benefits of Paying Mortgage with Credit Card

One of the biggest benefits of using a credit card for mortgage payments is the opportunity to earn reward points on mortgage credit card payments. Many credit cards offer cash back, air miles, or travel points, which can turn regular payments into significant rewards over time. Additionally, mortgage payment flexibility with credit card allows homeowners to maintain liquidity, particularly in times of financial strain. For example, homeowners can utilize the rewards accrued to offset expenses or enhance their travel experiences, effectively leveraging their mortgage repayment strategy into a more rewarding endeavor.

Potential Downsides of Using Credit Card for Mortgage

While the advantages are evident, there are also downsides to consider. The **interest rates on credit card for mortgage** payments can be substantially higher than typical mortgage rates, escalating the total repayment amount. Moreover, cash advances for mortgage payment may incur heavy fees, making it an expensive choice in the long run. It’s essential to understand these drawbacks and evaluate if the potential **credit card payment fees for mortgage** outweigh the rewards you may gain.

Alternatives to Credit Card Mortgage Payments

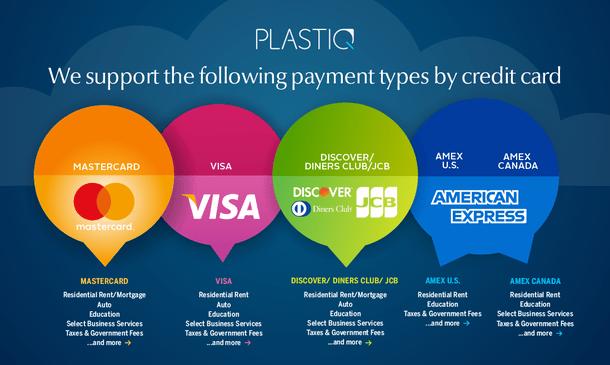

If paying your mortgage via credit card doesn’t seem advantageous, there are alternative methods as well. Many homeowners inquire about various **payment portal for mortgage** that accept direct payments, including traditional methods like bank transfers or using fintech payment services. Assessing these options is vital, especially if you’re concerned about leveraging credit cards due to their associated costs.

Managing Your Mortgage Payments Efficiently

When it comes to managing mortgage payments with credit cards, setting up a well-defined strategy can ensure a smoother financial experience. Understanding **credit card limits for mortgage payments** can often dictate how effectively you can use this method. You may need to speak to mortgage lenders who accept credit card payments and clarify any existing limits and restrictions to avoid any surprises down the line.

Integrating Credit Card Payments into Your Budgeting Strategy

Integrating your credit card payments into your overall financial plan can help maximize rewards while minimizing risks. One effective **mortgage payment strategy** is to restrict credit card usage solely for your mortgage to avoid *.ervenating your credit utilization ratio. By maintaining an organized monthly plan, you can stream your expenses effectively and keep track of your mortgage payments and credit card payments. This ensures that you stay ahead in managing debts on mortgage payments while availing the advantages of credit card payments.

Utilizing Online Resources for Mortgage Payment Tracking

Modern mortgage tracking tools allow homeowners to manage their mortgage payment status through digital platforms actively. Getting familiar with online mortgage payment options could significantly ease the burden of regular payments. Using tools or apps that track when you’ve used a credit card to pay your mortgage can enhance your ability to budget effectively, maximizing the benefits of credit card mortgage payments. Being diligent with your payment history and monitoring metrics can help safeguard your financial health.

Legalities of Paying Mortgage with Credit Card

One area homeowners must tread carefully on is the **legalities of paying mortgage with credit card**. Various state laws and individual lender restrictions may dictate whether this method is a viable option for you. It’s essential to maintain communication with your mortgage lender regarding credit card usage for payments. Gaining clarity on accepted practices ensures you are steering clear of potential pitfalls, which may lead to penalties or litigation regarding your mortgage agreement.

Exploring Credit Card Rewards for Mortgage Payments

Homeowners can further benefit from exploring effective credit card reward programs that cater specifically to mortgage payments. Understanding different **credit card rewards programs** enables you to pick the best card that aligns with your financial habits. Additionally, consumers can use accumulated rewards to perhaps pay down debt or reinvest into other areas of their finances, perfectly blending smart spending with mortgage responsibilities.

Choosing the Best Credit Cards for Mortgage Payments

With a plethora of options available, identifying the **best credit cards for mortgage payments** requires research and comparisons. Look into cards that offer stronger cash back or rewards ratios dedicated to home expenses. Moreover, scrutinizing any potential penalties or fees can heavily influence your choice. Engaging with customer reviews on mortgage and credit card payments can also provide a clearer picture of which financial tools provide the most significant benefits.

Maximizing Benefits while Mitigating Risks

To ensure a balance between benefits and drawbacks, develop a credit card payment strategy that enables mindful usage of funds while avoiding overwhelming credit debt. Utilizing educational tools and financial literature focused on **credit card payment history for mortgage** can inform smarter practices moving forward. Consider leveraging financial consultations to pinpoint personalized approaches that maximize the advantages while minimizing risks related to credit scores and overall financial health.

Key Takeaways

- Using a credit card to pay allows for flexibility and the opportunity to earn rewards.

- Be mindful of potential interest rates, fees, and legal implications associated with credit card payments.

- Carefully choose the right credit card that provides optimum rewards for mortgage payments.

- Track your payments and budgeting effectively to maintain stability while enjoying benefits.

- Understand the scope of mortgage lenders accepting credit card payments and their policies.

FAQ

1. Are there specific mortgage lenders that accept credit card payments?

Yes, some mortgage lenders accept credit card payments. However, it’s essential to verify with your lender if they allow this option as part of their payment processing policy. Always inquire about any associated fees or limitations when using a credit card for mortgage payments to make informed choices.

2. Can using a credit card to pay my mortgage impact my credit score?

Yes, using a credit card for mortgage payments can impact your credit score. It is vital to keep your credit utilization ratio in check, as high usage may negatively affect your credit score. Responsible usage where you pay off balances on time can help maintain or improve your score while taking advantage of rewards.

3. What are the fees associated with using a credit card for mortgage payments?

Many lenders may charge processing fees when accepting credit cards for mortgage payments. These fees can vary drastically, so it’s essential to inquire about the **credit card payment fees for mortgage** before making a decision. Always evaluate if the rewards you earn exceed these costs.

4. How can I best manage payments if I choose to pay my mortgage using a credit card?

Effective management starts by budgeting your credit card usage specifically for mortgage payments. Set reminders for payment periods and monitor usage to avoid potential debt accumulation. Using financial management tools designed for tracking mortgage payments via credit card can bolster your system.

5. What should I do if my credit card interest rates exceed my mortgage rates?

If the **interest rates on credit card for mortgage** payments are higher than your mortgage rates, consider alternate payment methods to avoid unnecessary interest costs. Utilizing direct payment through bank transfers or platforms that promote lower fees might be the most favorable option.

6. Are there advantages to refinancing my mortgage with a credit card?

Refinancing your mortgage with a credit card isn’t commonly offered and usually is not an advisable strategy due to high-interest rates. It is important to note that this option comes with significant financial risk, making traditional refinancing methods often a more strategic approach.

7. How are cash advances treated when paying a mortgage?

A cash advance for mortgage payments typically incurs higher fees and interest, and leveraging this option should only be considered for emergencies. It’s generally advisable to avoid cash advances for mortgage payments whenever possible to reduce unnecessary financial burdens.